Customer care numbers: +91 9137351396

Business Support: +91 8767805809 / +91 7715923881

IT Support: +91 9664685455

Company e-Mail: info@werconsultants.com

For support: support@werconsultants.com , mail@werconsultants.com

For service related grievances or complains call us at +91 8767805809/+91 7715923881 or send email toinfo@werconsultants.com

REGISTERED OFFICE / CORPORATE OFFICE

WeR Consultants LLP (Mumbai) :

D-8,Plot no 1,ARUNODAY CHS LTD ,GORAI-1,Behind Maxus cinema,BORIVALI WEST ,MUMBAI-400092,Maharashtra, India

BRANCH OFFICE

WeR Consultants LLP (Jaipur) : Plot no.A- 53, F-1 , satyam enclave, near sbi bank, Bhaskar enclave 2, patrkar colony, new sanganer road, Jaipur, Rajasthan 302020

WeR Consultants LLP (Vadodara) : Plot No-K-1/504/1,G.I.D.C Estate, Halol, Panchmahal, Vadodara-389350, Guajrat.

WeR Consultants LLP (Lucknow) : 2nd Floor, Chandrika Devi Bhavan (Near Saket Petrol Pump), Shankar Puri, Kamta, Lucknow-227105, Uttar Pradesh.

WeR Consultants LLP (Deoria) : Purwa Chauhraha, Gorakhpur Road, Opposite RTO Office, Deoria-274001, Uttar Pradesh.

Tax is calculated on your total income received during the year. If your total income includes any past dues paid in the current year, you may be worried about paying a higher tax on such arrears (usually tax rates have gone up over the years).

To save you from any additional burden of tax due to delay in receiving income, the tax laws allow a relief under Section 89(1). If you have received any portion of your salary in arrears or in advance, or you have received a family pension in arrears, you are allowed some tax relief under Section 89(1) read along with Rule 21A.

Starting income tax returns for the Financial Year 2014-15 (The Assessment Year 2015-16), the Income Tax Department has made it mandatory to file form 10E if you want to claim relief under Section 89(1).

Taxpayers who have claimed relief under Section 89(1) but have not filed form 10E have received an income tax notice from the Tax Department stating that –

The relief u/s 89 has not been allowed in your case, as the online form 10E has not been filed by you. The furnishing of Online form 10E is required as per sec.89 of the Income Tax Act

Filing the form is quite a simple process. Follow the given steps to file form 10E. These are:

Step 1:

Open the official portal of the Income Tax Department.

Step 2:

Log in to the portal using your credentials. These include User ID, Password, and Date of Birth.

Step 3:

From the top menu, click on the e-file option. In the tabs, select the “Prepare and submit Online form (other than ITR).”

Step 4:

A new page opens. Here, in the forms drop-down option, you need to select “Form 10E”. Along with this, you also have to enter the assessment year accordingly. Once done, click on “continue.”

Step 5:

A new page opens where you can find the instructions to file Form 10E.

Step 6:

Read all the instructions carefully and fill in the relevant details accordingly.

Step 7:

After filling in all the details, confirm and “Submit” the form.

In case the information and filing of the form could not be completed in one go, save it in the way of a draft to save the efforts of filing the arrangement all over again.

•File this form before filing the income tax return.

•Choose the correct financial and assessment years.

•To avail the benefits of tax relief, submit Form 10E as proof.

•Various details regarding the arrears and income have to be submitted while filing the form.

Section 89(1) and filing of Form 10E are efficient methods to save oneself from spending hefty amounts on taxes for their income. Without this form, the individuals are not allowed to avail of the benefits.

1.When was Form 10E introduced?

Form 10E was made mandatory by the income tax department from the financial year 2014-15.

2.How can form 10E be filed?

To file form 10E, visit the portal of the Income Tax Department, where you can find both the procedure and the form.

3.How should the assessment year be selected?

Select the assessment year according to the year of payment of arrears made.

4.When does the Form 10E have to be submitted?

Before filing the income tax returns, it is mandatory to fill this form to avail of the relief amount and its benefits.

5.Does the copy of Form 10E need to be submitted?

No. Since this is an online form-filing process; no copy has to be submitted along with the form.

Have any more questions regarding Form 10E or other calculations of relief?

Intellectual property rights are like any other property right. Its allows its creators, or owners, of patents, trademarks or copyrighted material to profit from their work or investment. These rights are described in the Universal Declaration of Human Rights, Article 27. These rights provide for the right to benefit from the protection of moral and material interests/benefits resulting from authorship of scientific, literary or artistic productions.

As we all know, under GST, tax is levied on the supply of ‘Goods’ or ‘Services’. The GST Act has provided a definition of ‘Goods’ [Section 2(52) of the Central Goods and Service Tax Act, 2017] as well as ‘Services’ [Section 2(102) of the Central Goods and Service Tax Act, 2017]. Further, the Act also deemed certain transactions as a supply of goods and deemed certain transactions as a supply of services [Schedule II of the Central Goods and Service Tax Act, 2017].

Intellectual property is an intangible right, and it is hence always difficult to conclude the form of the intellectual property i.e. whether it is ‘Goods’ or ‘Service’.

Notification no.11/2017 – Central Tax (Rate) dated 28th June 2017 provides CGST rates for supply of service. S.No. 17 of the said notification covers rates for intellectual property rights as follows:

(S.No. 17 -Heading17 Heading 9973 -)

1.(Leasing / rental services with or without operator) Temporary or permanent transfer or permitting the use or enjoyment of intellectual property rights in respect of goods other than Information Technology software 6%.

2.Temporary or permanent transfer or permitting the use or enjoyment of intellectual property rights in respect of Information Technology software 9%

Thus, from the above, one can easily conclude that under GST, intellectual property rights are treated as ‘Services’. However, confusion begins when we refer to point 4 i.e. ‘explanation’ contained in the said notification no.11/2017 – Central Tax (Rate) dated 28th June 2017.

As per explanation (ii) of point no. 4, it clearly states that the reference to ‘Chapter’, ‘Section’ or ‘Heading’ shall mean respectively as ‘Chapter’, ‘Section’ and ‘Heading’ in the Scheme of classification of service. It is worthwhile to note here that, heading 9973 of the scheme of classification of service covers only ‘licensing service’ i.e. temporary transfer for the right to use the intellectual property. Thus, it can be interpreted that the heading 9973 doesn’t cover the permanent transfer of intellectual property.

Due to confusion prevailing in the trade and industry and various cases involved in the matter, regarding intellectual property rights, to be treated as ‘Goods’ or ‘Services’, the GST council tried to clarified the points vide press release dated 10th November 2017.

In the said press release at entry (iii) of part (B), the GST council proposed that, irrespective of permanent intellectual property transfer is a supply of Goods or Services, the rate of GST would be as under –

1.GST rate would be 12%, in case of the permanent transfer of intellectual property rights other than Information Technology Software; and

2.GST rate would be 18%, in case of the permanent transfer of intellectual property rights in case of Information Technology Software.

38th GST Council meeting was held on 18 December 2019, Wednesday. It was chaired by our Hon’ble Union FM Nirmala Sitharaman and conducted at New Delhi.

The amount of ITC availed on a provisional basis restricted to 10% from the earlier 20%, where invoices or debit notes are not reflected in GSTR-2A. Hence, invoice matching must be frequently done and vendor communication becomes challenging.

The due date of GSTR-9 and GSTR-9C are extended further till 31 January 2020 from the earlier date of 31 December 2019. It was done to allow more time for taxpayers to use the offline tool of GSTR-9C that is expected to be made available on 21 December 2019.

Waiver of late fee for GSTR-1 for tax periods between Jul 17 and Nov 19, if filed by 10 January 2020. If the taxpayer does not still file for more than two consecutive tax periods, then e-way bills of such taxpayer will be blocked from generation.

The SOP is to be released for the benefit of tax officers about actions taken for non-filing of GSTR-3B. These will help in blocking or reversal of fake ITC availed.

The due date extension for GST returns for some North Eastern States (November 2019) to be extended till 31 Dec 2019.

Date of applicability is 1 March 2020

The GST Council imposes a uniform rate of 18% from earlier 12% on bags belonging to HSN code 3923/6305 from 1 January 2020 (woven and non-woven bags and sacks of polythene or polypropylene strips or the like , whether or not laminated, of a kind used for packing of goods including FIBC). It effectively removes the inverted tax structure.

Supply should be a long-term lease of an industrial or financial infrastructure plots. The Central or State Government holds 20% or more shares in the developer’s capital from the earlier share of atleast 50%. Exemption to apply from 1 January 2020.

The government has introduced an important change around the e-way bill generation with an aim to crack down on GST non-filers and evaders. With effect from December 2, 2019, the blocking and unblocking of the e-way bill generation facility has been implemented on the e-way bill portal. E-way bill generation has been barred for taxpayers who haven’t filed their returns for the previous two consecutive months.

As per GSTN data, around 20.75 lakh GSTINs have not filed their GSTR-3B for September and October months. Also, out of these 20.75 lakh GSTINs, around 3.47 lakh GSTINs (16.7%) had transactions for September and October 2019 in the e-way bill system. Considering the rise in the number of tax defaulters, their ability to generate e-way bill had to be blocked. The tax department is of the view that non-filing of returns has been the primary reason for the decline in the GST revenue collection.

Every taxpayer who is registered under GST must file GSTR-3B, on a monthly basis. GSTR-3B has details of sales and purchases made by a business and the final tax payable after claiming input credit.

As per the new rule, when a taxpayer fails to file his or her GST returns (GSTR-3B) for two continuous months, he or she will get blocked from generating an e-way bill. A GSTIN which is blocked cannot be used for generating an e-way bill either as a consignor or consignee.

Only after a blocked GST taxpayer files his/her pending GSTR-3B for the default period(s), the blocked GSTIN will get unblocked automatically the following morning allowing him/her to proceed with e-way bill generation.

In case a taxpayer intends to generate an e-way bill soon after filing his/her return, he or she can visit the e-way bill portal and choose the option ‘Search Update Block Status ‘. He or she will need to enter his/her GSTIN, later he or she will need to enter the CAPTCHA code and click on ‘GO’. In case the status reflects as ‘blocked’ then he/she need to click on the option ‘Update Unblock Status from GST Common Portal’. This button will extract the most-recent filing status via the GST common portal and, if the returns are filed, the e-way bill system status will get updated subsequently to ‘unblocked’.

Not generating an e-way bill will be considered as non-compliance as per the provisions of the GST law.

The business may not be able to deliver goods without an e-way bill. When goods are transported without an e-way bill, the authorities can claim that the consignor of the goods attempted to evade taxes and subsequently levy a fine equivalent to the tax amount payable. Such commodities and the vehicle transporting them can be seized or detained. Both the goods as well as the vehicle may be released only when the pending tax amount and the penalty mentioned by the concerned officer is paid.

Not possessing an e-way bill during transportation of goods can lead to the disruption in the day-to-day operations and deliveries of a business. This move will push taxpayers to be more compliant and make sure they file their returns/make their tax payments on time. Businesses need to be more careful by ensuring their GSTR-3B is filed within the deadline so that there is no disruption in their business-related operations. This new development within the e-way bill system may help improve GST revenue collection.

A delivery challan is a document created during the transportation of goods from one place to another which may or may not result in sales. This is sent along with the shipped goods. It contains the details of the items shipped, quantity of those goods, buyer and delivery address.

Generally, three copies of delivery challan are created:

1.Original: For the buyer

2.Duplicate: For the transporter

3.Triplicate: For the seller

There are various situations where a delivery challan may be issued:

• Goods being supplied on approval

• Goods being transported for job work

• Goods being transported for reason other than supply. Example: Transportation of goods from one warehouse to another warehouse of the supplier.

• Goods supply: Where the quantity of goods supplied is not known. Example: Supply of liquid gas, where quantity of supply from the place of supplier is not known at the time of supply.

• Transportation of goods in a semi-assembled state

A delivery challan typically contains the following details:

1.Date of Challan and Date of transportation

2.Serial Number of the challan – This is compulsory. It helps identify and easily refer to a challan.

3.Name, address, and GSTIN of sender and receiver. In case the receiver is not registered, his place of business must be

mentioned.

4.Details of Goods such as HSN Code, Description, Quantity, Taxable Value, GST Rate, GST Amount broken up into CGST,

IGST, SGST, and Cess.

5.Signature of sender or authorised person of sender.

6.Details of transportation such as mode and vehicle number.

Many times a single conveyance do not fulfil the consignment requirement entirely. Supplier or transporters may need two or more conveyances for shipment of the entire consignment. In such cases, a delivery challan comes in handy. Now the question arises how to generate an Eway bill when there is more than one conveyance involved to transport the same good in a single invoice?

Here are steps to be followed as laid down by GST law:

i. The supplier shall issue the complete invoice before dispatch of the first consignment

ii. The supplier shall issue separate delivery challans for each of the consignment giving reference to the invoice

iii. Separate Eway bill to be generated for each of the consignment

iv. The original copy of the invoice shall be sent along with the last consignment

v. The person in charge of the conveyance shall carry the Delivery challan, a copy of the duly certified original invoice and Eway bill for the respective consignment

A. Registered person i.e. consignor/supplier or consignee/recipient (if a supplier is unregistered).

B. The Transporter if neither of the above generates Eway bill. e-way bill requirement in above situation arises when consignment delivery is outsourced to a transporter who brings the goods from supplier’s warehouse to his warehouse for further distribution across the country.

i. Invoice/ Bill of Supply/ Delivery Challan related to the consignment of goods

ii. Transport by road – Transporter ID or Vehicle number if transporter has to be assigned

iii. Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document

In the above situation, a user must comply law through the issue of Delivery Challan and to understand the use of this document is important.

a. A GST tax invoice is issued when a supply of goods or services is made or when payment has been made by the recipient

b. In some situations, the movement of goods or provision of services may not necessarily result in Sale

c. There may be cases where goods are delivered in parts. This may be because of the size of goods like our above case

d. In such cases, instead of a tax invoice, a delivery challan is issued for transportation of goods

e. After the goods have been transported using a delivery challan, the supplier is required to issue a tax invoice for a delivery of goods

The following are the instances defined under the law when a delivery challan is issued:

i. Supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known

ii. Transportation of goods for job work

iii. Transportation of goods for reasons other than by way of supply

iv. Other supplies as notified by the Board

The supplier shall issue the Delivery challan and it is to be carried by the person in charge of a conveyance. A transporter has to issue DC where transportation is outsourced.

All in all, the Eway bill brings uniform rules which will be applicable throughout the country. The digital interface will facilitate faster movement of goods. It is bound to improve the turnaround time of vehicles and help the logistics industry reducing the travel time, unnecessary documentation as well as costs.

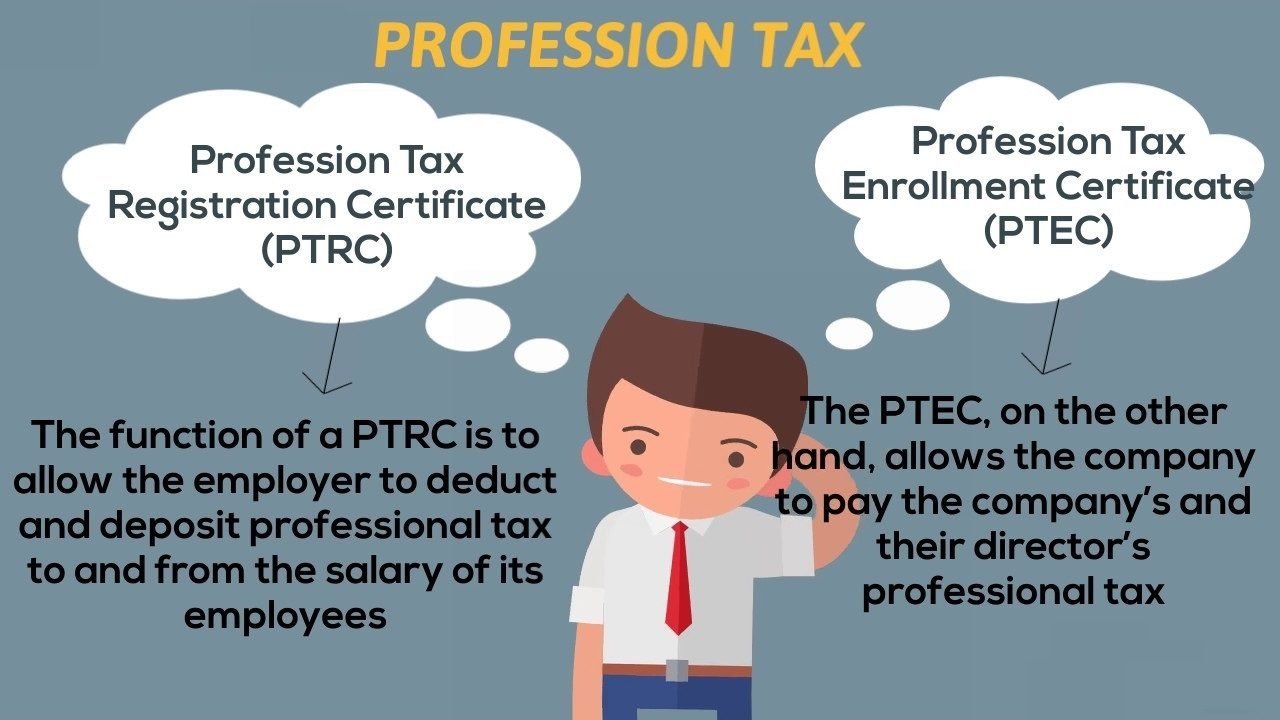

GST tax became applicable from 1st of July 2017 persons got themselves registered under the GST regime for various reasons, some mandatory while some voluntary, but little did they know that, they would be served with notices for non-registration and non-payment of profession tax under The Maharashtra State Tax On Professions, Trades, Callings And Employments Acts, 1975. This probably due to the integration of government websites and better coordination among various departments of tax authorities.

This article is restricted to The Maharashtra State Tax on Professions, Trades, Callings and Employments Acts, 1975.

Professional Tax becomes applicable once a person starts his business or profession. The person needs to get itself mandatorily registered within 30 days of starting the business or profession. Once a person is registered TIN is allotted by the department and the person can pay PT. The due dates for various persons have been provided in the Act. Generally, for individuals, the last date for payment of PT is 30th June of every year. For companies, the last date of payment is 31st March of every year if their PT liability does not exceed Rs. 50,000/- if however, the PT liability is beyond Rs. 50,000/- then monthly returns are to be filed and payment shall be made accordingly.

As per the amendments in the PT Act 1975, a person (natural/legal) registered under MGST Act is liable to enroll for Profession Tax Enrollment Certificate (PT-EC) and pay Rs.2500/- per annum which is levied in most cases. In addition, if the business is having any employee whose monthly salary is above Rs. 7500/- is also required to obtain Profession Tax Registration Certificate (PT-RC) and pay tax after deducting the same from the employee’s salary as per the provisions of law. Also, it should be noted that different rates of PT are specified for different businesses and professions.

If you are registered under MGST Act, and you have neither obtained PT-EC nor PT-RC, failure to comply with the provisions of the Act may result in penal proceedings. It is therefore advisable to enroll yourself under PT Act and also obtain PT Registration Certificate, if applicable and to pay off your PT liability at the earliest in order to avoid any further action from the department. One should also check their e-mails regularly including the spam folder for any department correspondence and seek professional assistance immediately so as to comply within the specified time frame if any.

The purchaser of an immovable property (whether built up or under construction) of value Rs 50 lakh or more has the responsibility under the Income Tax Act to pay withholding tax of 1% from the sale consideration payable to the seller of the property. This withholding tax must be deducted at source and deposited in the government’s account.

The due date of payment of TDS on transfer of immovable property is 30 days from end of the month in which the deduction is made.

PAN of the buyer and the seller is mandatory to make e-payment of TDS on sale of property. The TAN (Tax Deduction Account Number) is not required to make this payment.

TDS payment can be made by the buyer on the following

link:https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

To make an online payment of tax from the e-tax payment option, the buyer is required to fill an online form, 26QB. PAN of the buyer and seller, details of the property, total consideration payable, and payment details must be furnished.

TDS needs to be paid on the amount paid/payable to the seller. The buyer can make the payment using the e-tax payment option. The tax payment can be made via net banking portal or by visiting authorised bank branches. Once the payment is made, an acknowledgement number is generated. On entering the acknowledgment details at a later date, one can generate the submitted Form 26QB for records.

Once tax payment is made, Form 16B (TDS certificate to be issued by the buyer to the seller) can be downloaded from the website of Centralised Processing Cell of TDS (CPC-TDS) at www.tdscpc.gov.in

If the property transaction has more than one party as a buyer or seller, Form 26QB needs to be filled by each buyer for unique buyer-seller combination.

The ITR (income-tax return) form varies depending on source(s) of income. Use of incorrect ITR form can result in the return being treated defective.Such assesses are given intimation under Section 139(9), asking them to rectify the mistake within 15 days.”If the error is not rectified, the return is treated invalid, and the I-T department will deem it to be a case of non-filing,” .

Interest income from banks — savings and fixed deposits — and post office must be reported while filing returns. “Interest income should be shown in the return even when Form 15G or 15H has been filed, provided the earning is not exempt under Section 10 and total income exceeds the maximum amount not taxed,”.By filling Form 15G/15H, one can prevent tax deducted at source (TDS) if taxable income is below the basic exemption limit, or filer is a senior citizen.Incomes such as dividend, interest on tax-free bonds, eligible gifts, etc should also be reported even though they are tax exempt.

“Filing tax return is not just about paying tax, but also about disclosing sources of income, so that if filer is questioned about his income at a later date, he can justify it using his tax return,”.

A discrepancy between income reported in Form 26AS and in the return filed by the filer can lead to the I-T department making preliminary adjustments and sending a notice under Section 143(1).The assesses gets 30 days to respond online.

Sometimes the taxpayer does not include some income or the other while preparing her. his return that has been captured by Form 26AS.”Before filing the return, look up From 26AS to avoid such mistakes,” Sometimes, credit for TDS is not included in Form 26AS. In case, TDS has been deducted but is not reflected in Form 26AS, follow up with the entity doing the deduction to get the records updated.

Sometimes, certain exemptions do not get reflected in Form 16.This can happen because proof of investment was submitted late.Taxpayers are entitled to claim those exemptions while filing their return, provided they have the supporting documents.

Taxpayers also make mistakes when they have multiple Form 16s.”They have difficulties in figuring out how much tax deduction to enter in their returns. They usually see a tax payable if they forget to disclose salary from first employer to the second employer,”

Loss under ‘capital gains’ and under ‘business or profession’ cannot be carried forward for set-off in subsequent years (loss on house property is the exception).

1.If a person has undertaken a high-value transaction (reflected in Form 26AS, based on annual information return filed by banks and other financial institutions), his income shown in tax return should be in line and not too low.

2.Employees who did not submit rent receipt to employer, but still want to claim HRA, tend to miscalculate exempt portion of HRA in tax return.

3.Computing fair market value of shares

4.Calculating indexed cost of purchase of an asset.

5.Expenses that qualify for deduction as cost when a capital asset is sold.

A finance company is an organization that makes loans to individuals and businesses. Unlike a bank, a finance company does not receive cash deposits from clients, nor does it provide some other services common to banks, such as checking accounts. Finance companies make a profit from the interest rates (the fees charged for the use of borrowed money) they charge on their loans, which are normally higher than the interest rates that banks charge their clients.

Many finance companies lend to clients who cannot obtain loans from banks because of a poor credit history (the record of an individual’s payments to the institutions who have loaned him money in the past). Such clients secure their loans with finance companies by offering collateral (by pledging to give the company a personal asset, or possession, of equal value to the loan if payment on the loan is not made).

what are the basic registrations required to get the finance company/ Firm as legal firm status under the respective acts/ laws, to carry on the business with objects of business of finance/ lending business is the main question. There may be a no. of ways, but being a Company Secretary, in my point of view are the ways for getting the firms registered for doing the business as Finance Company which shall be valid under the respective acts and which shall allow the business concerns to carry on the business of lending and taking deposits from the general public.

An Act to consolidate and amend the law relating to co-operative societies, with objects not confined to one State and serving the interests of members in more than one State, to facilitate the voluntary formation and democratic functioning of co-operatives as people’s institutions based on self-help and mutual aid and to enable them to promote their economic and social betterment and to provide functional autonomy ,was being felt necessary by the various cooperative societies, and federation of various cooperative societies as well as by the Government. In order to achieve the objective The Multi State Cooperative Societies Bill was introduced in the Parliament. The bill having been passed by both the Houses of Parliament received the assent of the President on 3rd July 2002 and it came on the Statute Book as The Multi State Cooperative Societies ACT 2002 (39 of 2002).

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities etc. A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company).

A Company registered under Companies Act 2013 and desirous of commencing the business of Non Banking Financial Institutions as defined under Section 45 (1)(a) of RBI Act, 1934 should have a minimum new owned fund of Rs. 2 crores. Companies are required to submit its applications for registration in the prescribed format along with necessary documents with Reserve Bank of India for their verifications and in case the RBI is satisfied with the intention of promoters and the documents being provided by them, the certificate of NBFC shall be issued to them which comprises of two category.

Category A: These are those NBFC Companies which deal in advancing of loan as well as accepting of deposits

Category B: These are those NBFC Companies which deal in only providing of advances and loan to general public. The permission of accepting the deposits is not allowed to such companies under category B.

The Third and the trending way to get the Finance Companies registered is incorporating of Nidhi Companies. This is the trending way which is prevailing among a no. of promoters to incorporate the Nidhi Companies and to start the business of finance along with accepting the deposits.

Nidhi Companies were existed even prior to the existence of companies Act 1913. The basic concept of Nidhi is “Principle of Mutuality” (“Paraspara Sahayata”). Thus Nidhis function for the common benefit advantage of all their Members/Share holders. These companies are more popular in South India and 80% of Nidhi companies located in Tamil Nadu.

A NIDHI COMPANY, is one that belongs to the non-banking Indian Finance sector and is recognized under section 406 of the Companies Act, 2013. Their core business is borrowing and lending money only between their members. They are also known as Permanent Fund, Benefit Funds, Mutual Benefit Funds and Mutual Benefit Company. It is regulated by Ministry of Corporate Affairs. Reserve Bank of India is empowered to issue directions to them in matters relating to their deposit acceptance activities. However, in recognition of the fact that these Nidhis deal with their shareholder-members only.

1. These are the mutual benefit companies being incorporated to benefit the members/ shareholders of the company

2. Company can accept the deposits and can advance the loans subject to restrictions being imposed under the act and allied rules.

3. Need not to have a Huge Net worth of Rs. 2 cores as required for running NBFC Companies.

4. Need not to follow the stringent provisions issued by Reserve Bank of India from time to time as being followed in NBFC Companies.