Customer care numbers: +91 9137351396

Business Support: +91 8767805809 / +91 7715923881

IT Support: +91 9664685455

Company e-Mail: info@werconsultants.com

For support: support@werconsultants.com , mail@werconsultants.com

For service related grievances or complains call us at +91 8767805809/+91 7715923881 or send email toinfo@werconsultants.com

REGISTERED OFFICE / CORPORATE OFFICE

WeR Consultants LLP (Mumbai) :

D-8,Plot no 1,ARUNODAY CHS LTD ,GORAI-1,Behind Maxus cinema,BORIVALI WEST ,MUMBAI-400092,Maharashtra, India

BRANCH OFFICE

WeR Consultants LLP (Jaipur) : Plot no.A- 53, F-1 , satyam enclave, near sbi bank, Bhaskar enclave 2, patrkar colony, new sanganer road, Jaipur, Rajasthan 302020

WeR Consultants LLP (Vadodara) : Plot No-K-1/504/1,G.I.D.C Estate, Halol, Panchmahal, Vadodara-389350, Guajrat.

WeR Consultants LLP (Lucknow) : 2nd Floor, Chandrika Devi Bhavan (Near Saket Petrol Pump), Shankar Puri, Kamta, Lucknow-227105, Uttar Pradesh.

WeR Consultants LLP (Deoria) : Purwa Chauhraha, Gorakhpur Road, Opposite RTO Office, Deoria-274001, Uttar Pradesh.

GST tax became applicable from 1st of July 2017 persons got themselves registered under the GST regime for various reasons, some mandatory while some voluntary, but little did they know that, they would be served with notices for non-registration and non-payment of profession tax under The Maharashtra State Tax On Professions, Trades, Callings And Employments Acts, 1975. This probably due to the integration of government websites and better coordination among various departments of tax authorities.

This article is restricted to The Maharashtra State Tax on Professions, Trades, Callings and Employments Acts, 1975.

Professional Tax becomes applicable once a person starts his business or profession. The person needs to get itself mandatorily registered within 30 days of starting the business or profession. Once a person is registered TIN is allotted by the department and the person can pay PT. The due dates for various persons have been provided in the Act. Generally, for individuals, the last date for payment of PT is 30th June of every year. For companies, the last date of payment is 31st March of every year if their PT liability does not exceed Rs. 50,000/- if however, the PT liability is beyond Rs. 50,000/- then monthly returns are to be filed and payment shall be made accordingly.

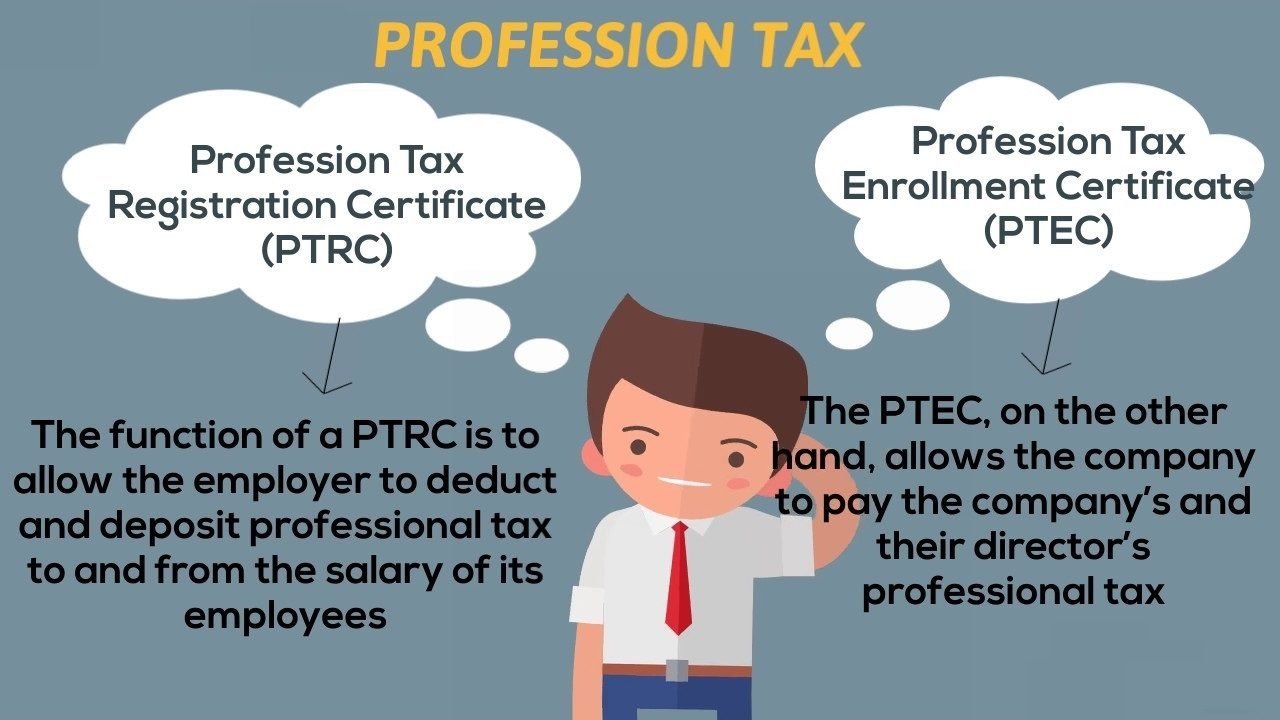

As per the amendments in the PT Act 1975, a person (natural/legal) registered under MGST Act is liable to enroll for Profession Tax Enrollment Certificate (PT-EC) and pay Rs.2500/- per annum which is levied in most cases. In addition, if the business is having any employee whose monthly salary is above Rs. 7500/- is also required to obtain Profession Tax Registration Certificate (PT-RC) and pay tax after deducting the same from the employee’s salary as per the provisions of law. Also, it should be noted that different rates of PT are specified for different businesses and professions.

If you are registered under MGST Act, and you have neither obtained PT-EC nor PT-RC, failure to comply with the provisions of the Act may result in penal proceedings. It is therefore advisable to enroll yourself under PT Act and also obtain PT Registration Certificate, if applicable and to pay off your PT liability at the earliest in order to avoid any further action from the department. One should also check their e-mails regularly including the spam folder for any department correspondence and seek professional assistance immediately so as to comply within the specified time frame if any.