Customer care numbers: +91 9137351396

Business Support: +91 8767805809 / +91 7715923881

IT Support: +91 9664685455

Company e-Mail: info@werconsultants.com

For support: support@werconsultants.com , mail@werconsultants.com

For service related grievances or complains call us at +91 8767805809/+91 7715923881 or send email toinfo@werconsultants.com

REGISTERED OFFICE / CORPORATE OFFICE

WeR Consultants LLP (Mumbai) :

D-8,Plot no 1,ARUNODAY CHS LTD ,GORAI-1,Behind Maxus cinema,BORIVALI WEST ,MUMBAI-400092,Maharashtra, India

BRANCH OFFICE

WeR Consultants LLP (Jaipur) : Plot no.A- 53, F-1 , satyam enclave, near sbi bank, Bhaskar enclave 2, patrkar colony, new sanganer road, Jaipur, Rajasthan 302020

WeR Consultants LLP (Vadodara) : Plot No-K-1/504/1,G.I.D.C Estate, Halol, Panchmahal, Vadodara-389350, Guajrat.

WeR Consultants LLP (Lucknow) : 2nd Floor, Chandrika Devi Bhavan (Near Saket Petrol Pump), Shankar Puri, Kamta, Lucknow-227105, Uttar Pradesh.

WeR Consultants LLP (Deoria) : Purwa Chauhraha, Gorakhpur Road, Opposite RTO Office, Deoria-274001, Uttar Pradesh.

A pan card issued by Income Tax department to link all financial Transitions such as Tax payment, TDS/TCS credits, Income Tax return and other specified transitions.

The PAN stand Permanent Account Number and PAN card issued in form of Smart card which has mention details like name, age and date of birth, A pan card use for filing of Income Tax return ,Bank account opening, applying for other personal documents like passport, Driving license .

However to obtain PAN card must fill out a form. There are two types of form namely form no.49A and 49AA.

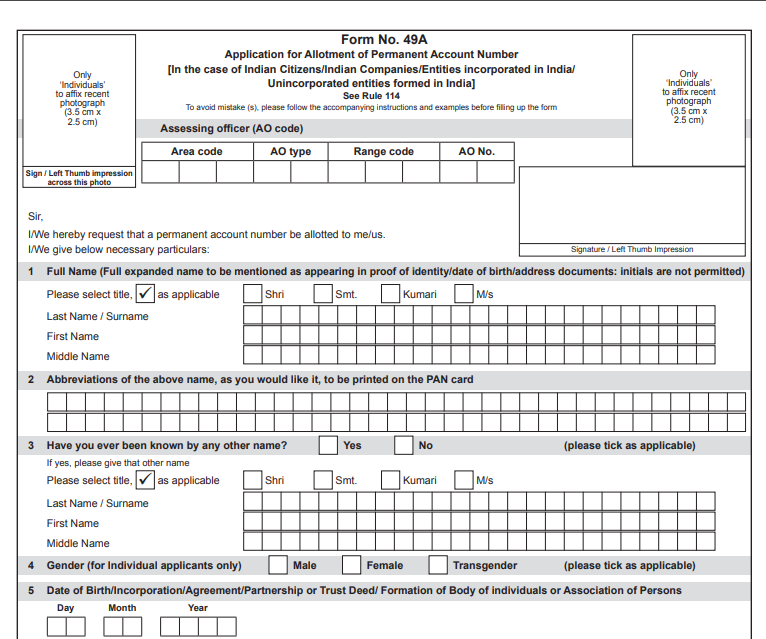

1. Form no.49A is for citizen, companies, and entities staying and formed within India.

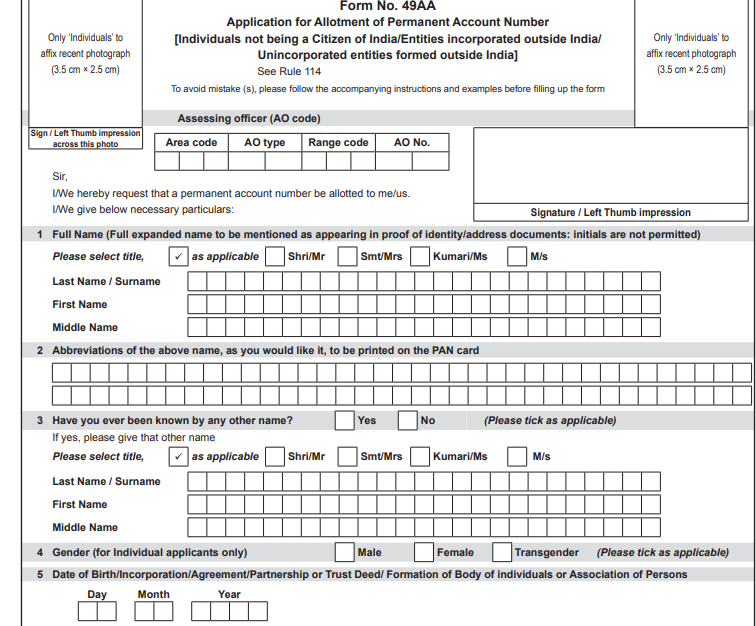

2. Form no.49AA is for individual not being a citizen of India/Entities incorporated outside India.

Proof of documents –

1. Proof of Identity.

2. Proof of Address.

3. Proof of date of birth.

Note-

1. Aadhaar Card as a proof is necessary for PAN card during application.

2. For E-Pan Card email id is mentioned in Pan Application form.

3. Department will give you two options for Pan card-1. Physical Pan card 2. E-Pan card. If you opted Physical Pan Card option then a laminated PAN card will be printed and dispatched at communication address. And if you opted E-pan card then E-PAN card in PDF format will be send to E-mail ID.

49A

49AA